Updated: April 22, 2022 : 2 min read

The Current State of the Section 179 Tax Deduction

After years of constant change- up and down deduction limits, shifting depreciation rates, retroactive measures taken in the following calendar year- 2021 finds the Section 179 tax deduction for capital equipment continuing to trend toward stability, with limits that are very similar to those of the last two years. If you have plans for a major equipment purchase in the near future, we'll explore what you can expect to save this year with Section 179.

Section 179 in 2021

This year's Section 179 looks an awful lot like it did in 2019 and 2020 which, if you've followed the deduction over the years, is already surprising. Here's the situation this year:

The deduction limit has risen slightly from $1,040,000 in 2020 to $1,050,000. As long as your equipment is purchased and in service by the end of the day on December 31st, 2021, you qualify to deduct the full amount.

The spending cap has risen slightly from $2,590,000 in 2020 to $2,620,000. Once you hit the spending cap, your deduction will begin to decrease dollar-for-dollar. For example: equipment costing $2,630,000 is 10k over the threshold and would only be allowed to deduct $1,050,000, with another dollar coming off the deduction for every additional dollar spent. This would leave you with a final deduction of $1,040,000.

The Bonus Depreciation rate remains static at 100%. Some years there's no bonus depreciation at all, so to have it carry over at 100% from 2020 is a nice perk for businesses that will be purchasing above the spending cap in 2021.

Calculating Your Savings

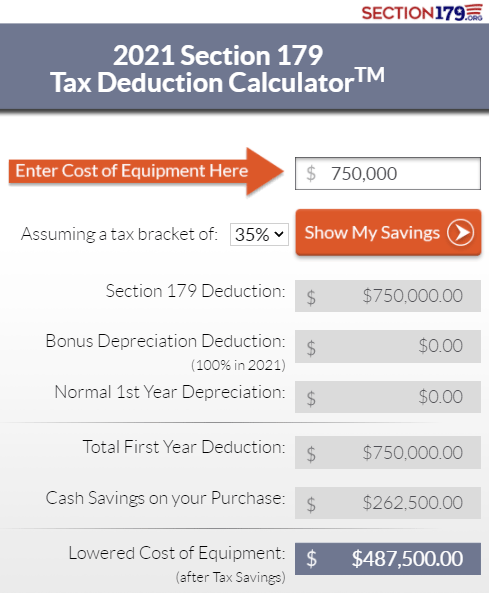

As they've done for years, the official website of Section 179, www.section179.org features a calculator tool for figuring out how much you can save on an equipment purchase in 2020 when you take advantage of the deduction. If you're considering a major purchase in the near future, we suggest you check it out.

Below is an example screenshot of an equipment purchase of $750,000. Click on the image if you'd like to visit the calculator and see your own results.

Why Should I Use Section 179 in 2021?

With only 2 and a half months of 2021 remaining, some might be wondering why they should hurry to push through a purchase this year. It's a great question. Our answer: the deduction is the highest it's ever been and, for those of you seeking equipment on the secondary market (remember-section 179 applies to both new AND used systems), the limits are well within the pricing of most items you could be considering. While Section 179 probably isn't going away in 2022, there's no guarantee what it will look like.

The Takeaway

Whatever imaging projects you might be considering, if you're a small or mid-sized business seeking equipment, Section 179 is in place to help you save thousands (or hundreds of thousands) of dollars on your purchase.

If you're ready to take advantage of Section 179, our team is ready to help with equipment, project management, installation, and ongoing service. Use the button below to tell us what you're looking for or speak with our team directly at 517-688-8800.

Chris Sharrock

Chris Sharrock is the Vice President of Healthcare Solutions at Block Imaging. Each day Chris sets out to provide the best equipment, parts, and service solutions for healthcare facilities across the world. Outside of work Chris enjoys playing in a band, and spending time at the lake with his family.